Tag Archive for EU

Europe’s upcoming Fourth AML/CFT Directive

In February 2013, the European Commission adopted two proposals: the Fourth AML Directive and a complementary regulation on what information must accompany fund transfers to ensure traceability. The European Parliament’s and European Council’s so-called “draft directive on the prevention of the use of the financial system for the purpose of money laundering and terrorist financing”…

4th EU Money Laundering Directive – New challenges for companies

Implementing the 4th EU AML Directive

The road to FATCA and the Fourth EU Directive– Customer Due Diligence requirements revisited

Financial institutions are faced with the challenge of aligning their existing Know Your Customer (KYC) due diligence processes to meet FATCA requirements. This article outlines the background and international discussions regarding tax evasion and the ongoing debate to curtail it, and seeks to touch upon the impact it will have in dealing with should be: high-risk clients in regions, which are considered high risk for tax evasion.

Enhanced due diligence is a must to mitigate AML exposure in Turkey

Reinforcing Integrity Risk Management – “Customer Due Diligence” Requirements Reworked

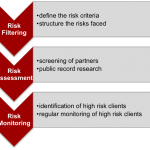

One of Risk Management’s most important cogwheels, for the purpose of investigating and detecting a wide range of reputational risks and economic crimes, is the due diligence process. As described in former articles published on Global Risk Affairs, due diligence requirements are largely anchored in legislation dealing with the prevention of money laundering, fraud, corruption…

The Baltic States and the North Eastern European Criminal Hub

The Baltic States are located in what EUROPOL maps out as the North-East Criminal Hub. Given their geographical location, the Baltic States facilitate not only the illegal entry and distribution of goods and people within the EU, but also the making of financial crime committed through the region’s financial institutions.