Risk Assessment

The Fourth EU AML/CTF Directive

This article will focus on one of the most recent initiatives by the EU, which underlines the continued importance of revising and improving existing anti-money laundering/ counter-terrorist financing (AML/CTF) legislative frameworks both within the individual member states and also in a cross-border context in terms of the cooperation between relevant national authorities.

Corruption Risk Assessment

Europe’s upcoming Fourth AML/CFT Directive

In February 2013, the European Commission adopted two proposals: the Fourth AML Directive and a complementary regulation on what information must accompany fund transfers to ensure traceability. The European Parliament’s and European Council’s so-called “draft directive on the prevention of the use of the financial system for the purpose of money laundering and terrorist financing”…

Whitepaper & Webcast – Risk Assessment and Prevention of Corruption

Companies are depending on the countries and the industries in which they operate, as well as working together with their business partners, to assess corruption risks. However, the best way to find out how their respective business processes can be affected by corrupt practices, is the implementation of a systematic risk assessment.

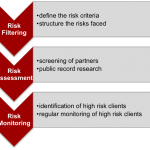

Business partner screening and risk assessment in the prevention of money laundering

An integrated approach to business partners compliance

The road to FATCA and the Fourth EU Directive– Customer Due Diligence requirements revisited

Financial institutions are faced with the challenge of aligning their existing Know Your Customer (KYC) due diligence processes to meet FATCA requirements. This article outlines the background and international discussions regarding tax evasion and the ongoing debate to curtail it, and seeks to touch upon the impact it will have in dealing with should be: high-risk clients in regions, which are considered high risk for tax evasion.

Enhanced due diligence is a must to mitigate AML exposure in Turkey

Reinforcing Integrity Risk Management – “Customer Due Diligence” Requirements Reworked

One of Risk Management’s most important cogwheels, for the purpose of investigating and detecting a wide range of reputational risks and economic crimes, is the due diligence process. As described in former articles published on Global Risk Affairs, due diligence requirements are largely anchored in legislation dealing with the prevention of money laundering, fraud, corruption…