Due Diligence

An integrated approach to business partners compliance

The road to FATCA and the Fourth EU Directive– Customer Due Diligence requirements revisited

Financial institutions are faced with the challenge of aligning their existing Know Your Customer (KYC) due diligence processes to meet FATCA requirements. This article outlines the background and international discussions regarding tax evasion and the ongoing debate to curtail it, and seeks to touch upon the impact it will have in dealing with should be: high-risk clients in regions, which are considered high risk for tax evasion.

Supply Chain Due Diligence – the Case of Conflict Minerals and Beyond (II)

Country Risk: Venezuela’s unsavory relationships

Supply Chain Due Diligence – the Case of Conflict Minerals and Beyond (I)

Political Integrity at Risk

Reinforcing Integrity Risk Management – “Customer Due Diligence” Requirements Reworked

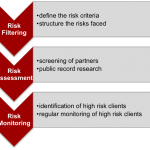

One of Risk Management’s most important cogwheels, for the purpose of investigating and detecting a wide range of reputational risks and economic crimes, is the due diligence process. As described in former articles published on Global Risk Affairs, due diligence requirements are largely anchored in legislation dealing with the prevention of money laundering, fraud, corruption…

SADC-UNODC a regional initiative to combat crime in Southern Africa

Integrity Due Diligence – Towards an integrated approach to Compliance (II)

Corporations and institutions can attain a strategic and competitive advantage by pursuing an integrated approach to integrity due diligence. By assessing the trustworthiness and reliability of customers, business partners and any third parties, organisations ensure the fulfilment of compliance requirements, whilst concurrently facilitating a concerted effort to combat money laundering, fraud and corruption (‘MLFC’) –…